In the last couple of weeks, I have experienced two very contrasting approaches to service recovery or complaint handling and find it fascinating that the way in which the issues were handled were so completely different. Usually, making comparisons is about identifying some differences within a structure that is basically the same or similar, whereas in the examples I am sharing here, I think you will agree that such a comparison is impossible because the two approaches are as different as night and day. In the interest of time and to remove my personal opinion/bias I have listed a chronology of events for each situation:

First up, a Big Four bank

January 2017 – May 2018

- Moved business address

- Realised that monthly bank statements were not available online (current and reserve accounts)

- Reported to bank and was advised that it was due to the change of address which could only be rectified by going into branch to complete a form.

- Completed form in branch and was told it would take some time to “process”.

- Some months later the statements were still not available online and the bank advised that I should request copies of all past statements to be posted to me and the system would then “reboot” itself. Some days later, a handwritten envelope arrived which had ripped because the documents sent were too heavy – somebody in Royal Mail placed the envelope in a secure cellophane envelope.

- After several weeks, the statements were still not available online

- I reported this and the bank suggested that I lodge a formal complaint.

- I explained the whole series of events again and waited for further news.

- Before receiving any further contact, a small credit appeared on my bank transactions and when I queried this was told that my problem had been resolved, that this was an amount paid for “compensation” and that the matter was closed. Any explanation of how the amount was arrived at was not given and when I explained my dissatisfaction with the way the complaint was handled, the bank advised that I could report it to the financial ombudsman.

- The current account statements were now available online…. but the reserve account statements were not.

- I queried why I had been told that the problem had been resolved when in fact it had not and after more days had passed I was told that the reserve account had been overlooked in error. I explained my frustration with the process and lack of response, the negligence regarding data protection, the unilateral closure of the complaint and the length of time involved (now approaching 15 months). I explained that I did not want to take the matter to the FO but just wanted some acknowledgement of how frustrating this matter had been for a longstanding loyal customer. I asked for the contact details of the head of Customer Experience for the bank. The response was to suggest that the matter be referred to the Executive Complaints team and when I explained that I wanted to contact a senior exec in customer experience directly was told “Senior executives in Customer Experience don’t deal with customers”.

- A week later I have heard nothing further. A call that was promised was subsequently cancelled at short notice because the person was “in a meeting”.

Second Up, a big online retailer

29-30th April 2018

- Noticed a hairline fracture across the mosaic top of a recently purchased outside bistro table

- Emailed the online retailer and received a prompt response offering a 20% discount if I could still make use of the table.

- Responded to decline the offer explaining my concern that the crack could become worse over time and make the table useless.

- Received a prompt email from the online retailer advising that a replacement table would be sent and that I should use the damaged table for spare parts or throw it away.

When I was working in hotels this model attributed to Disney was used and I have not come across anything better since:

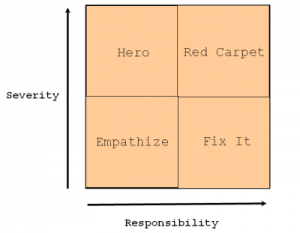

The quadrants are determined by the level of responsibility and severity of the problem and this is used to guide the response. Here are some examples to bring the theory to life:

Empathise (Low severity/low responsibility) – a conference event organiser complains about the rain limiting the outdoor activities

“I can understand how disappointed you are, especially when the forecast was for a sunny day. I can offer…..

Fix it (low severity/high responsibility) – a shopper returns a shirt because a button is missing

“Would you like a replacement shirt or a refund?”

Red carpet (high severity/high responsibility) – the host of a dinner party has wine spilt on a jacket by a member of the restaurant service team

“We are so sorry for this accident and will arrange for the jacket to be dry cleaned or give you the money if you would prefer to do this yourself. Also, we would like to offer you a bottle of wine with our compliments, the next time to dine with us”

Hero – a hotel guest left their passport in the room and has left for the airport

“We found your passport in your room and one of our team will bring it to you at the airport”

In all cases, the severity of the problem is from the guest’s perspective which is variable.

Another model that is valuable is the LEARN model when dealing with a complaint following this process:

Listen – rather than quote process or justification for the situation

Empathise – show some understanding of how the other person is feeling

Apologise – be sorry that the other person has had this poor experience – this does not mean accepting fault

React – deal with the issue and solve the problem

Notify – whoever in the organisation needs to know to prevent reoccurrence

At a client workshop, an attendee suggested to add T for Thank – thank the person for raising the issue because this gives us the chance to resolve it. So now I use the LEARNT service recovery model.

I wonder if the big online retailer uses these models with its customer service people. Whatever is being used, they are doing a great job. As for the Big Four bank, just think of the cost of handling a single issue with one customer, the potential loss of a loyal customer and the number of times this story will be told. Whether or not the bank will notice any negative commercial impact is unclear but what is certain is that it will not help their financial performance.

Sometimes things do not go as planned with a customer experience. However, when this happens, the best SERVICEBRANDs react in the right way. It is said that a customer who has had a complaint resolved successfully is more loyal than a customer who has not had a problem in the first place! Complaints can be a great opportunity to improve the customer experience, address shortcomings and create a strong sense of loyalty.